Home Inspection vs. Appraisal: Why You Need Both When Buying a Home

When you’re in the process of buying a home, you’ll hear a lot about both home inspections and appraisals. Although they might seem similar, they actually serve two distinct purposes, both essential to protecting your investment and making sure you’re getting a fair deal. Let’s break down what each one does—and why they’re both worth the time and cost.

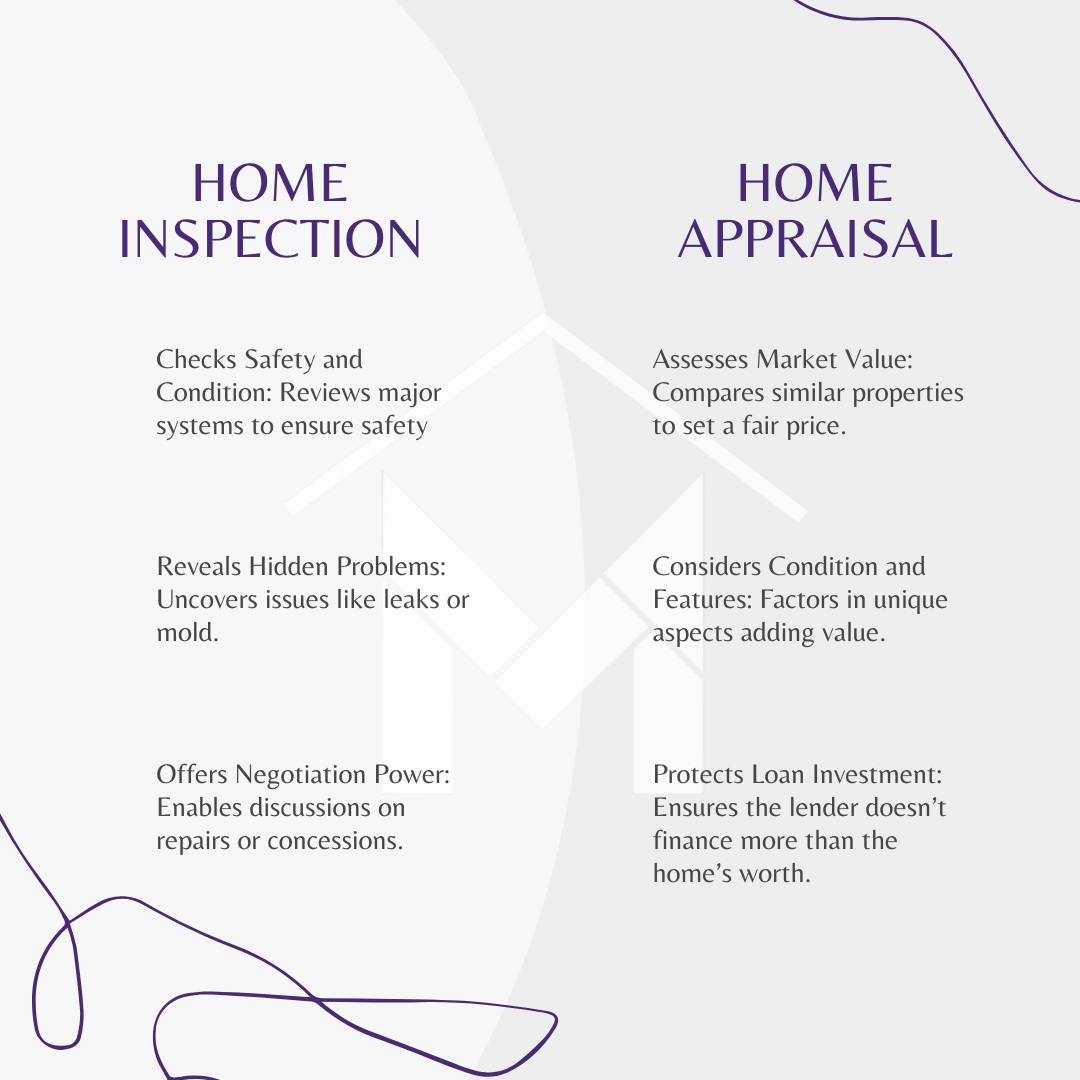

Home Inspection: All About Condition and Safety

A home inspection focuses on the condition of the property. A licensed inspector will look over the home thoroughly to spot any potential issues, large or small, that could affect your experience as a homeowner. Here’s what it typically covers:

• Structure & Systems: Inspections check key areas like the roof, foundation, plumbing, and electrical systems to make sure everything is safe and functioning properly.

• Hidden Issues: Safety hazards or problems that may not be immediately obvious—like leaks, electrical faults, or mold—are identified, giving you a chance to address them before moving in.

• Negotiation Power: If major repairs are needed, this information lets you negotiate with the seller on fixes or concessions. It’s peace of mind for you as the buyer, ensuring you’re aware of what’s under the surface.

Think of the inspection as your detailed report on the home’s physical health. You’ll get a full picture of any potential repair needs so you’re not hit with surprises down the road.

Appraisal: Verifying Fair Market Value

While the inspection focuses on condition, an appraisal is all about value. Lenders require an appraisal to make sure the property is worth what you’re planning to pay for it. Here’s what an appraisal typically involves:

• Market Comparisons: Appraisers assess the home’s value based on recent sales of similar properties (often called “comps”) in the area.

• Home Condition and Features: While it’s not as detailed as an inspection, an appraisal does factor in the property’s condition, location, and any unique features that add value.

• Loan Approval: The appraisal helps your lender confirm that they’re not financing more than the home is worth. If the appraisal comes in lower than the agreed price, you may need to renegotiate or make up the difference in cash.

This process protects both you and the lender, ensuring you’re making a sound investment that’s in line with current market values.

Why Both Matter

Together, these two steps give you a complete view of the home:

Inspection: Helps you know what you’re getting into regarding the home’s physical condition and any repair costs.

Appraisal: Confirms that the price aligns with the home’s market value, ensuring you’re not overpaying.

Skipping either of these could mean missing out on important information about the home’s quality or value, which could lead to unexpected expenses or even a financial loss.

Ready to Dive Deeper?

Navigating the homebuying process can be complex, but it’s easier with the right guidance. At Mosaic Realty Group, we’re here to answer all your questions and ensure you have the knowledge and confidence to make the best choices for you. Whether it’s understanding inspections, appraisals, or anything else on your real estate journey, we’ve got you covered.

Have questions? Message us anytime!

#HomeWithMosaic #DFWrealestate #homebuyingtips #firsttimehomebuyer